Businesswoman Dawseanne Williams did not foresee credit card fraud in her future when she made a simple and routine deposit into her local bank using one of its Automatic Teller Machines (ATM) in September 2022.

In her rush to get home, Ms. Williams forgot to remove her card from the machine.

Her folly triggered an excruciating episode that played out in a magistrate court where a young female suspect incurred a criminal record for the crime and the stolen returned to the owner.

“As I was driving home, I began getting automatic bank alerts informing me about the amount of money deducted from my account for transactions, but I was driving home, I knew I was not conducting any transaction, so I stopped the car and checked my purse and to my astonishment, the card was not in my purse,” Ms. Williams recalled.

“I had left it at the machine or loss it, it was a Friday night, so my option was to notify the bank but by the time I did I had lost more than EC$2000, and my hard earn cash was disappearing before my eyes and it appears that my options were limited to stop the transaction,” she continued.

The bank with whom Ms. Williams has her account states on its website, under loss and stolen card, that it is the responsibility of the holder to safeguard the debit card. However, if the debit card is lost or stolen the holder should notify the bank by phone or in writing, so that its system can block new transactions from being authorized against the account.

The notice further warns, “Remember that transactions performed before you notify us of any issues or unauthorized usage will remain your responsibility.”

“I realized that all the purchases were made online at shopping sites, the user was on a shopping spree, purchasing mainly clothing items and then there was a purchase at a local restaurant. By Saturday morning I got a name to these transactions after I did my investigation and then decided to post about that person’s behavior on my Facebook page,” said the businesswoman, who by then had decided to get the police involved.

After posting about her predicament on her Facebook page, she received a message from a person who was not on her friendship list claiming that she had retrieved the card at an ATM and given it to another person to drop at the Police station.

That unknown messenger, after police, conducted a thorough investigation, turned out to be Jasmine Cyrus – the person who was using the card. Evidence from the Bank handed over to the Police also showed it was she who got the card at the ATM. Charges were filed and on October 28th 2022 the matter was brought to the St George’s magistrate court. However, instead of pleading guilty to the offense of theft, Cyrus offered to repay the money.

“All along that is what I wanted, I wanted my money back, if she had given me my money, this matter may not have reached in front the magistrate. Anyway, I agreed to accept in front of the magistrate, and the Court decided she will have a record against her name. However, while listening to the prosecution present its case to the magistrate (before she offers to repay) it was there and then I realize how serious is this crime which is slowly becoming a significant headache for law enforcement,” said Williams.

Police said that Ms. Williams’s experience of having someone use her debit card without her authorization is no longer a rare occurrence but one that is linked directly to the increasing use of the internet to engage in financial and other transactions.

“People are using cards for everything from shopping at local establishments online to shopping regionally and internationally. People are walking around with less cash and using cards and so losing a card is like losing your purse full of actual money, the difference is you can minimize card spending by reporting to the bank,” said Officer Keron St Clair, who is attached to the Financial Intelligence Unit.

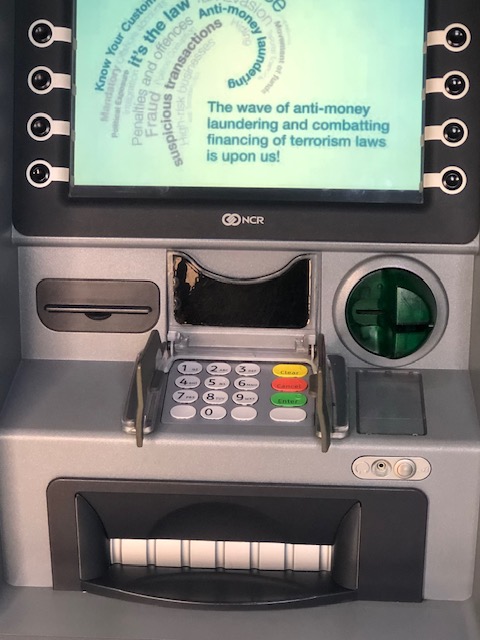

“It’s a growing crime and we think that the number of reports we receive is significantly lower than what is happening. Some people are not reporting due to embarrassment and shame, but we realize it’s happening more than it is reported,” said St Clair who according to the FIU law is one of the officers responsible for the Investigation of matters arising from suspicious transaction reports, money laundering, terrorist financing, and other financial crimes.

Records from the FIU, whose mission is to prevent and detect money laundering, terrorist financing, and other serious financial crimes, through collaboration with local, regional, and international stakeholders show that Grenadians lost more than EC$100,000 through unauthorized use of debit and credit cards for the period 2015 to 2022.

“During that period, we investigated 12 matters and 6 of them during 2022, and already for the year there are two matters under investigation,” said St Clair. “So, as you can see it growing and people are becoming more confident to report it to us. Most of these online transactions are done by people who are shopping online, and it involves both unemployed and employed people who instead of returning a card to the bank or the name printed on the card are instead engaging in online shopping with card that don’t belong to them or they have permission to use,” he said.

“That type of shopping is illegal because according to the law they are not authorized to use the card, and what you find happening in the process of the investigation is that these people are violating at least four different laws. These include the Electronic Crimes act and the Electronic Transfer of Funds Crime Act. These pieces of legislation were only enacted in 2013 and they provide for some stiff penalties,” he said.

“A person who uses a card without authorization can be charged with Electronic Fraud, and this is provided for in Section 9 of the Electronics Crimes Act 23 of 2013. The Penalty under that law is a fine not exceeding $100, 000 or three years imprisonment or both,” he said.

There is also a charge of Fraud by Electronic Communication provided for in Section 441(1) of the Criminal Code Chapter 72A of Volume 4 of the 2010 Continuous Revised Edition of the Laws of Grenada. The Penalty is a fine of $50, 000 or 10 years imprisonment, or both once that person is found guilty.

Some people are also charged under the criminal code for the offense of theft.

Enacted in 2013 is the Electronic Transfer of Funds Crimes Act says in section five, “A person who receives a card that he knows or ought to reasonably know to have been lost, mislaid, or delivered under a mistake as to the identity or address of the cardholder and who retains possession with intent to use, sell, or to traffic it to a person other than the issuer or the cardholder commits an offense and is liable on summary conviction to a fine not exceeding twenty thousand dollars or to a term of imprisonment not exceeding two years or to both.”

“I think most people are not aware of this law but because of the circumstances of how cards are used without authorization it will be most effective to charge for the crime of stealing the money instead of just having the card in their possession, so the charge under the Electronic Transfer of Funds Crimes act can be an additional offense,” he said.

“The laws enacted in 2013 adjusted our laws for those types of crime, they are laws that fit into the world where technology and electronic devices are standard operations and not uncommon, but it will still incorporate some aspects of the criminal code offenses,” said St Clair.

When financial institutions offer both credit and debit cards there is a strong focus on safety and accessibility but very few people seem to read the terms and conditions of the agreement before signing up for the card.

“Very few people I know will sit down and read the agreement most people don’t read the agreements of most contracts and they only learn of a certain clause when something happens,” said former banker Michael Archibald. “It’s just a fact, contract reading, whether it’s for the debit or credit card, a loan, insurance policy, just about anything…people just sign,” he said.

Lawyer Peter David who has represented several clients in money laundering matters admitted that he has never read the account holder agreement for accepting and using the credit or debit card. “I don’t think I know of anybody who has read that agreement before signing it, that is an agreement that is signed onto because of what is told and understood and not what is read and understood. As for me, I am guilty of never reading that agreement and I am a lawyer,” he said.

A review of the agreement for e-banking service from a financial institution with thousands of customers said, “The Account Holder must take all reasonable precautions to prevent fraudulent or unauthorized use of or access to the Account Holder’s Access Codes and/or other security details.

The agreement further explained that an Account Holder shall take every precaution to ensure the safety, security, and integrity of the Accounts of the Account Holder, Instructions, and transactions when using the eBanking Service.

Losing money through the unauthorized use of credit and debits is not limited to an individual using the card. Still, it can also be done through card skimming, Identity theft, Phishing, ATM Shoulder Surfing, ATM Card Swapping, and ATM Card Swapping.

“The aim of all these is illegal, the goal is to get information that will lead to a card becoming compromised. Some of these include the targeting of financial institutions systems, and is, for this reason, the message is never disclosed your information such as your PIN to anyone,” St Clair said.

Card skimming is when a card reading device is used to copy account information when you swipe the debit or credit card. These devices are very small and can be easily carried around. Once fraudsters get this information, they can create a clone of your debit or credit card and use this clone to withdraw large amounts of money from your account.

Financial institutions are unwilling to disclose data on the number of cards that have been compromised for 2015 to 2022 but in discussion with dozens of cardholders, a significant number have admitted receiving a call from a financial institution informing them that their card was compromised and a new one will be provided.

“Up to now I don’t know how my card was compromised, I received a called from the bank and was told that my card was compromised, so I complied by returning the card and receiving a new one, now that I am talking to you, I realize should have asked for questions,” said a female who prefer to remain anonymous.

Larry Lawrence, Managing Director of the Grenada Cooperative Bank and current president of the Grenada Bankers Association said If a bank’s customer reports an unauthorized ATM Card transaction, banks will investigate the transaction to determine if it was fraudulent.

“If the transaction is determined to be fraudulent, the Bank will reimburse the customer for the amount of the unauthorized transaction. It is important to note that banks will not cover losses resulting from the customer’s own negligence, such as failing to protect their ATM card and PIN. For example, the Bank will not reimburse customers for transactions that required the use of their PIN or card-present fraud, where the card was physically presented to conduct a transaction,” he said.

“In addition, Banks will refund customers for card number enumeration fraud. This type of fraud mainly occurs online and involves a technique used by criminals to guess valid card numbers. This technique involves systematically generating and testing different combinations of numbers until a valid card number is found. In such cases, customers will be refunded,” he assured.

“Bank customers should take appropriate measures to protect their ATM card and personal information to minimize the risk of fraudulent transactions. This includes not sharing their ATM card or PIN with anyone, regularly monitoring their bank account activity for unauthorized transactions, and reporting any suspicious activity to their Bank or financial institution immediately,” Lawrence said.

A review of the Financial Intelligence Unit report for 2019 to 2021 shows 192 suspicious activity reports in 2019 while there were 71 and 82 for 2020 and 2021 respectively.

“Filings were concentrated across only 4 sectors Banks, Credit Unions, Money Service Businesses, and Insurance,” said Grenada’s latest Mutual Evaluation Report which was launched in July 2022. Banks filed 50 reports while credit unions filed 15 such reports.

(Following the writing of this piece the Financial Intelligence Unit release a video warning about the unauthorized use of credit and debit cards.)

This is an investigation completed by Linda Straker for Caribbean Investigative Journalism Network with the support of the International Center for Journalists (ICFJ) as part of the Investigative Journalism Initiative in the Americas.